Price: $0 - $1,00,000

$5000

Metal Type: 1

Product Type : 1

$15000

Metal Type: 2

Product Type : 2

Home / Gold

Showing all 18 resultsSorted by price: low to high

0.01 oz

Metal Type: 1

As Low As : $ 29.21

Product Type : 1

Learn More

66821359 oz

Metal Type: 1

As Low As : $ 280.84

Product Type : 3

Learn More

0.1 oz

Metal Type: 1

As Low As : $ 309.48

Product Type : 3

Learn More

0.1 oz

Metal Type: 1

As Low As : $ 335.66

Product Type : 3

Learn More

0.25 oz

Metal Type: 1

As Low As : $ 777.77

Product Type : 3

Learn More

0.25 oz

Metal Type: 1

As Low As : $ 790.89

Product Type : 3

Learn More

0.5 oz

Metal Type: 1

As Low As : $ 1523.93

Product Type : 3

Learn More

0.5 oz

Metal Type: 1

As Low As : $ 1557.16

Product Type : 3

Learn More

1 oz

Metal Type: 1

As Low As : $ 2899.72

Product Type : 3

Learn More

1 oz

Metal Type: 1

As Low As : $ 2902.25

Product Type : 1

Learn More

1 oz

Metal Type: 1

As Low As : $ 2947.7

Product Type : 3

Learn More

1 oz

Metal Type: 1

As Low As : $ 2954.73

Product Type : 3

Learn More

1 oz

Metal Type: 1

As Low As : $ 2957.46

Product Type : 3

Learn More

1 oz

Metal Type: 1

As Low As : $ 2961.01

Product Type : 3

Learn More

1 oz

Metal Type: 1

As Low As : $ 2961.67

Product Type : 3

Learn More

1 oz

Metal Type: 1

As Low As : $ 2996.67

Product Type : 3

Learn More

10 oz

Metal Type: 1

As Low As : $ 29408.37

Product Type : 1

Learn More

32.15 oz

Metal Type: 1

As Low As : $ 94981.13

Product Type : 1

Learn More

0.01 oz

Metal Type: 1

As Low As : $ 29.21

Product Type : 1

Learn More

1 oz

Metal Type: 2

As Low As : $ 32.9

Product Type : 3

Learn More

1 oz

Metal Type: 2

As Low As : $ 34.06

Product Type : 1

Learn More

1 oz

Metal Type: 2

As Low As : $ 35.19

Product Type : 3

Learn More

1 oz

Metal Type: 2

As Low As : $ 35.2

Product Type : 3

Learn More

1 oz

Metal Type: 2

As Low As : $ 35.49

Product Type : 1

Learn More

1 oz

Metal Type: 2

As Low As : $ 35.57

Product Type : 3

Learn More

1 oz

Metal Type: 2

As Low As : $ 35.66

Product Type : 3

Learn More

1 oz

Metal Type: 2

As Low As : $ 35.77

Product Type : 3

Learn More

1 oz

Metal Type: 2

As Low As : $ 35.9

Product Type : 3

Learn More

66821359 oz

Metal Type: 1

As Low As : $ 280.84

Product Type : 3

Learn More

0.1 oz

Metal Type: 1

As Low As : $ 309.48

Product Type : 3

Learn More

10 oz

Metal Type: 2

As Low As : $ 329.71

Product Type : 1

Learn More

0.1 oz

Metal Type: 1

As Low As : $ 335.66

Product Type : 3

Learn More

0.25 oz

Metal Type: 1

As Low As : $ 777.77

Product Type : 3

Learn More

0.25 oz

Metal Type: 1

As Low As : $ 790.89

Product Type : 3

Learn More

32.15 oz

Metal Type: 2

As Low As : $ 1119.14

Product Type : 1

Learn More

0.5 oz

Metal Type: 1

As Low As : $ 1523.93

Product Type : 3

Learn More

0.5 oz

Metal Type: 1

As Low As : $ 1557.16

Product Type : 3

Learn More

71.5 oz

Metal Type: 2

As Low As : $ 2418.27

Product Type : 3

Learn More

1 oz

Metal Type: 1

As Low As : $ 2899.72

Product Type : 3

Learn More

1 oz

Metal Type: 1

As Low As : $ 2902.25

Product Type : 1

Learn More

1 oz

Metal Type: 1

As Low As : $ 2947.7

Product Type : 3

Learn More

1 oz

Metal Type: 1

As Low As : $ 2954.73

Product Type : 3

Learn More

1 oz

Metal Type: 1

As Low As : $ 2957.46

Product Type : 3

Learn More

1 oz

Metal Type: 1

As Low As : $ 2961.01

Product Type : 3

Learn More

1 oz

Metal Type: 1

As Low As : $ 2961.67

Product Type : 3

Learn More

1 oz

Metal Type: 1

As Low As : $ 2996.67

Product Type : 3

Learn More

100 oz

Metal Type: 2

As Low As : $ 3320.95

Product Type : 1

Learn More

500 oz

Metal Type: 2

As Low As : $ 17821.2

Product Type : 3

Learn More

500 oz

Metal Type: 2

As Low As : $ 17872.1

Product Type : 3

Learn More

10 oz

Metal Type: 1

As Low As : $ 29408.37

Product Type : 1

Learn More

32.15 oz

Metal Type: 1

As Low As : $ 94981.13

Product Type : 1

Learn MoreBuying gold online is safe, convenient, and can be done 24/7. Buying online allows you to browse our entire selection of products, compare prices and premiums, and order when you want. GoldSilver has been one of the internet’s most trusted gold bullion dealers since 2005 and ships to nearly every country in the world.

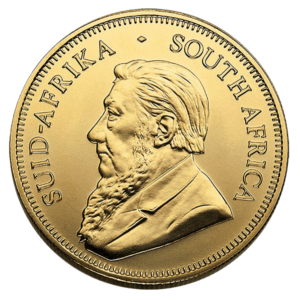

Our catalog of gold bullion products is curated by some of the top experts in the precious metals industry. Our goal is to offer investors gold coins, gold bars, and bullion-grade gold jewelry (22k and 24k solid gold) with low premiums and high purity, because we believe precious metals carry intrinsic value that can persist through any monetary or economic storms.

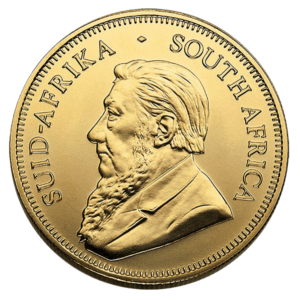

The most popular gold coins we carry are:

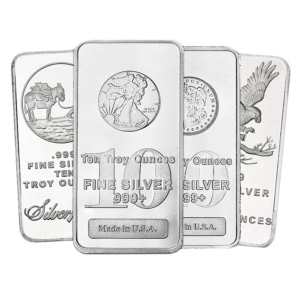

And our best-selling gold bars are:

Physical gold is finite, tangible, portable, and divisible, making it an ideal form of money that can hold its value over time. Although many view gold as a safe haven asset, we also see potential for massive price appreciation. Demand is high around the globe, and gold bullion is highly liquid- almost any bullion dealer in the world will recognize an American Gold Eagle and buy it from you.

To learn more about why you should own physical gold, read our Top 10 Reasons to Own Gold.

Many U.S. investors choose to purchase precious metals in Individual Retirement Accounts (IRA), because of their tax-free or tax-deferred status. Using a simple “self-directed” IRA, you can invest in true physical gold and silver and still enjoy these tax benefits.

Don’t already have a metals-ready IRA? You can open one just 5 minutes and choose tax-deferred or tax-exempt investing accounts. Read more

Unlike many other online bullion dealers who market and sell thousands of items, GoldSilver carefully curates a catalog of gold bullion products that we believe represent the best opportunities for discerning investors.

We offer gold coins and bars from the following government (sovereign) mints:

As well as the following private mints:

There is no safer way to store your gold than professional vault storage. Home storage risks your safety as well as your investments. Get peace of mind with 24/7 security at the world’s most secure, private, non-bank vaults. We’ve partnered with Brinks to offer secure storage vaults nearby and around the world, including:

Gold investments in storage can be sold with a few clicks, and funds available to trade again quickly. Interested in vault storage? Learn more about our allocated and segregated secure vault storage programs.

The price of gold fluctuates constantly in the markets. This can make pricing somewhat challenging for many dealers. But we’ve created a program that updates the prices of our products in real time in accordance with the spot price of gold at the time of purchase. We also have a price match guarantee to match the advertised price of any of our products on the sites of our top competitors.

To learn more about how you can always get the best price on gold bullion from GoldSilver, read about our price match guarantee.

GoldSilver will buy back most bullion products, whether you bought them from us or elsewhere, with competitive prices and an easy-to-use online sales portal — by mail or from storage. If you decide to sell some of your precious metals holdings, you have a ready buyer on standby.

Read more about our sell-back policy, request a quote for your precious metals, or find out why our sell-back policy and storage program are a match made in heaven.

At GoldSilver, we pride ourselves on offering investors a world-class education, an investor-friendly product catalog, and a uniquely secure and flexible storage program.

Our educational videos have generated tens of millions of views on YouTube. Our founder, Mike Maloney, is the best-selling author of Guide to Investing in Gold & Silver, the most popular book ever on precious metals investing.

Our catalog is focused on physical precious metals products with the most competitive premiums, as we believe those products allow investors to get maximum exposure to gold & silver and increase potential profits by saving on costs.

And our unique storage program offers allocated and segregated storage options, at your choice of global vaults, with rapid liquidity.

Together, we believe these features offer an unmatched experience for precious metals investors.

But, don’t take our word for it. See what our investors are saying about us: read our testimonials.

Join Our Newsletter!

Customer Service

485 Lexington Avenue, Suite 304 New York, NY 10017

[email protected]

(888) 319-8166

Se Habla Espanol!

®2025 GoldSilver, LLC All Rights Reserved

Join Our Newsletter!

485 Lexington Avenue, Suite 304 New York, NY 10017

[email protected]

(888) 319-8166

Se Habla Espanol

® 2025 GoldSilver, LLC All Rights Reserved

Samantha is wonderful. I was nervous about spending a chunk of money. I asked her to `hold my hand’ and walk me through making my purchase.

She laughed and guided me through, step by step. She was so helpful in explaining everything...

Travis was amazing! I was having difficulty with a wire transfer of my life’s savings, and I was very worried that I might not be able to receive it all. My husband just passed away and I’ve been worried about these funds along with grieving for 8 months. As soon as I got connected with Travis, my concerns were immediately addressed and he put me at ease. The issue was resolved within days. He even called me back with updates to keep me in the loop about what was going on with the funds. I am so grateful for a customer representative like Travis. He really cares for his clients.

Sam was also very helpful! I called and was connected to Sam within 30 seconds. She helped me with a fee that was charged to my account. She had a great attitude and took care of the fee quickly.

Let our team of experts help you with any questions:

Outstanding quality and customer service. I first discovered Mike Maloney through his “Secrets of Money” video series. It was an excellent precious metals education. I was a financial advisor and it really helped me learn more about wealth protection. I used this knowledge to help protect my clients retirements. I purchase my precious metals through goldsilver.com. It is easy, fast and convenient. I also invested my IRA’s and utilize their excellent storage options. Bottom line, Mike and his team have earned my trust. I continue to invest in wealth protection and my own education. I give back and help others see the opportunities to invest in precious metals. Thank you.